Calendar Put Spread

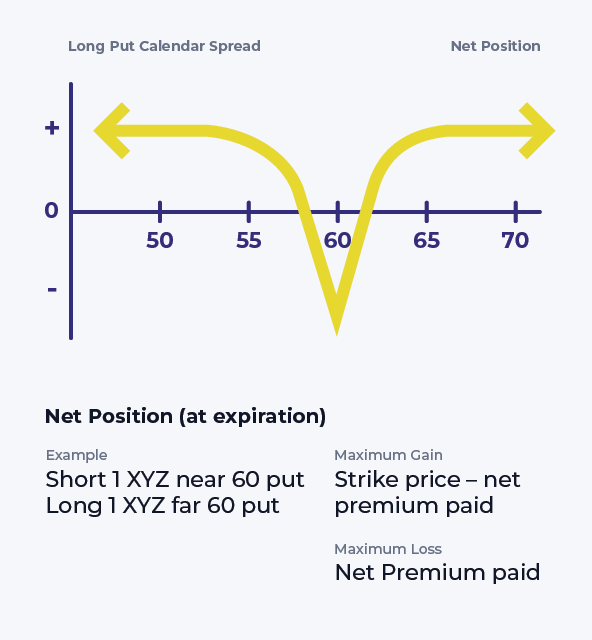

Calendar Put Spread - Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. Calendar spreads allow traders to construct a trade that minimizes the effects of time. A trader may use a long put calendar spread when they expect the stock price to stay steady or rise slightly in the near term. A long calendar spread is a good strategy to use when you expect the. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited risk in either direction.

Calendar Call Spread Strategy

A long calendar spread is a good strategy to use when you expect the. A trader may use a long put calendar spread when they expect the stock price to stay steady or rise slightly in the near term. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased.

Calendar Spread Margin Norah Annelise

The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited risk in either direction. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month.

What Is A Calendar Spread Option Strategy Mab Millicent

Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited risk in either direction. A trader may use a.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Calendar spreads allow traders to construct a trade that minimizes the effects of time. A long calendar spread is a good strategy to use when you expect the. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A trader may use a long put calendar spread when they expect.

Calendar Put Spread Options Edge

A trader may use a long put calendar spread when they expect the stock price to stay steady or rise slightly in the near term. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited risk in either direction..

Advanced options strategies (Level 3) Robinhood

A long calendar spread is a good strategy to use when you expect the. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited risk in either direction. Calendar spreads allow traders to construct a trade that minimizes the.

Options Trading Made Easy Ratio Put Calendar Spread

The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited risk in either direction. Calendar spreads allow traders to construct a trade that minimizes the effects of time. A long calendar put spread is seasoned option strategy where you.

Long Put Calendar Spread (Put Horizontal) Options Strategy

Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. A long calendar spread is a good strategy to use when you expect the..

Long Calendar Spread with Puts Strategy With Example

A long calendar spread is a good strategy to use when you expect the. A trader may use a long put calendar spread when they expect the stock price to stay steady or rise slightly in the near term. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in.

Options Strategy Calendar Spread (Setting Up the Calendar) Tradersfly

A long calendar spread is a good strategy to use when you expect the. Calendar spreads allow traders to construct a trade that minimizes the effects of time. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited risk.

Calendar spreads allow traders to construct a trade that minimizes the effects of time. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited risk in either direction. A long calendar spread is a good strategy to use when you expect the. A trader may use a long put calendar spread when they expect the stock price to stay steady or rise slightly in the near term. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position.

A Long Calendar Put Spread Is Seasoned Option Strategy Where You Sell And Buy Same Strike Price Puts With The Purchased Put Expiring One Month Later.

Calendar spreads allow traders to construct a trade that minimizes the effects of time. Calendar spreads are a great way to combine the advantages of spreads and directional options trades in the same position. A long calendar spread is a good strategy to use when you expect the. The calendar spread options strategy is a market neutral strategy for seasoned options traders that expect different levels of volatility in the underlying stock at varying points in time, with limited risk in either direction.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)