Short Calendar Spread

Short Calendar Spread - There are two types of calendar spreads: The typical calendar spread trade involves the sale of an option (either a call or put). A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price but with different expiration dates. This strategy can be used with both calls and puts. Selling an option contract you don’t yet own creates a “short” position. How does the short calendar spread work, and what are the potential benefits and risks? A short calendar spread with calls is an options. A short calendar spread with calls is created by. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement.

Calendar Call Spread Option Strategy Heida Kristan

The typical calendar spread trade involves the sale of an option (either a call or put). How does the short calendar spread work, and what are the potential benefits and risks? A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price but with different expiration dates. There.

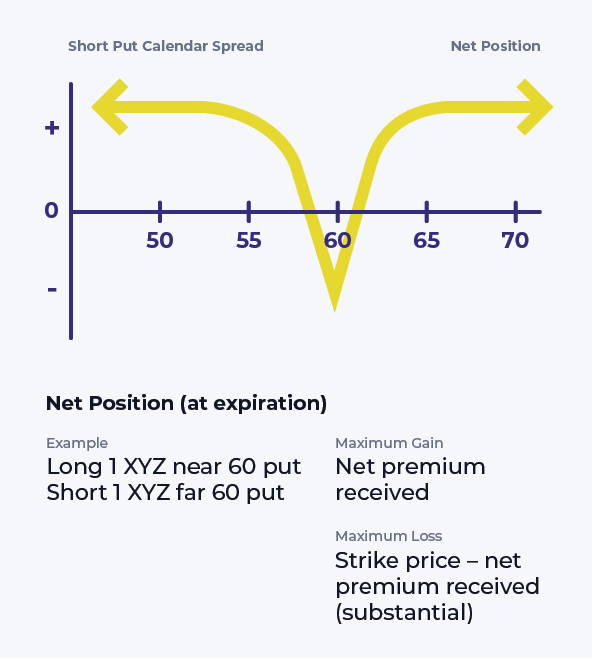

Short Put Calendar Spread Printable Calendars AT A GLANCE

A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price but with different expiration dates. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. Selling an option contract.

Short Calendar Spread Printable Word Searches

Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. There are two types of calendar spreads: Selling an option contract you don’t yet own creates a “short” position. To profit from a large stock price move away from the strike price of the calendar.

Calendar Spreads 101 Everything You Need To Know

Selling an option contract you don’t yet own creates a “short” position. This strategy can be used with both calls and puts. How does the short calendar spread work, and what are the potential benefits and risks? A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price.

PPT Trading Strategies Involving Options PowerPoint Presentation, free download ID4213867

This strategy can be used with both calls and puts. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike.

What Is A Calendar Spread Option Strategy Mab Millicent

The typical calendar spread trade involves the sale of an option (either a call or put). This strategy can be used with both calls and puts. A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price but with different expiration dates. To profit from a large stock.

Short Put Calendar Spread Options Strategy

Selling an option contract you don’t yet own creates a “short” position. The typical calendar spread trade involves the sale of an option (either a call or put). This strategy can be used with both calls and puts. A short calendar spread with calls is an options. Learn how to use a short calendar call spread to profit from a.

Short Calendar Put Spread Staci Elladine

To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. A short calendar spread with calls is created by. The typical calendar spread trade involves the sale of an option (either a call or put). A calendar spread is an options strategy.

Calendar Spreads Option Trading Strategies Beginner's Guide to the Stock Market Module 28

How does the short calendar spread work, and what are the potential benefits and risks? To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. A short calendar spread with calls is created by. A short calendar spread with calls is an.

Calendar Spread Options Trading Strategy In Python

There are two types of calendar spreads: A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price but with different expiration dates. The typical calendar spread trade involves the sale of an option (either a call or put). A short calendar spread with calls is created by..

A short calendar spread with calls is created by. A short calendar spread with calls is an options. This strategy can be used with both calls and puts. A calendar spread is an options strategy that involves buying and selling options on the same underlying security with the same strike price but with different expiration dates. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. The typical calendar spread trade involves the sale of an option (either a call or put). Selling an option contract you don’t yet own creates a “short” position. There are two types of calendar spreads: How does the short calendar spread work, and what are the potential benefits and risks?

A Calendar Spread Is An Options Strategy That Involves Buying And Selling Options On The Same Underlying Security With The Same Strike Price But With Different Expiration Dates.

This strategy can be used with both calls and puts. Selling an option contract you don’t yet own creates a “short” position. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. A short calendar spread with calls is an options.

How Does The Short Calendar Spread Work, And What Are The Potential Benefits And Risks?

The typical calendar spread trade involves the sale of an option (either a call or put). Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. There are two types of calendar spreads: A short calendar spread with calls is created by.